As we approach the end of the financial year, it's crucial to stay informed about four upcoming Super and Tax changes set to take effect.

If you need more information about any of these changes and how they may effect your specific situation, do not hesitate to contact us.

-

Stage 3 Tax Cuts:

Prime Minister Anthony Albanese has introduced revisions to stage three tax cuts—the most substantial and contentious phase of income tax cuts in Australia—aimed at enhancing benefits for lower and middle-income earners.

Since January, the government's decision to alter the composition of the stage three tax cuts has dominated headlines. Following considerable debate within Coalition ranks, the Liberal party chose not to obstruct the passage of the new laws, which were formally ratified by the Senate and enacted into law on February 27. These changes will come into effect at the commencement of the fiscal year on July 1, 2024.

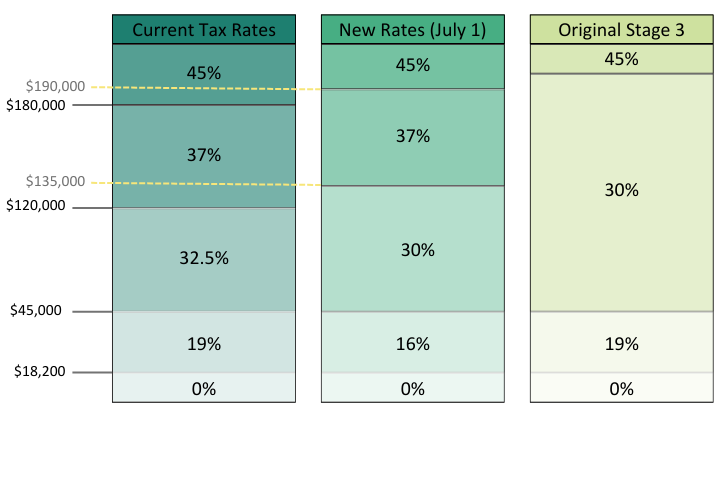

Originally intended to eliminate the 37% marginal tax bracket entirely and reduce the 32.5% marginal tax rate to 30%, stage three tax cuts were designed to raise the threshold for the top 45% marginal tax rate from $180,000 to $200,000. This would result in individuals earning between $45,000 and $200,000 paying the same 30% tax rate, effective from July 1, 2024.

Although the overall cost of stage three remains unchanged, the Albanese government has adjusted tax cuts for higher-income earners in favour of those with lower and middle incomes.

The most significant alteration compared to the original plan is the retention of the 37% tax rate, albeit with a higher upper limit of $190,000. In exchange, the tax brackets for the two lowest income levels have been reduced.

-

Increased Concessional & non-concessional Super contribution caps:

As of July 1st there will be an increase to Super contribution caps. This adjustment, the first of its kind in three years, promises benefits for both concessional and non-concessional contributors, but understanding its implications is key to maximizing its potential for your financial future.

The decision to raise super contribution limits stems from a 4.5% increase in 'average weekly ordinary time earnings' (AWOTE), as reported by the Australian Bureau of Statistics (ABS). This uptick triggers adjustments to both concessional and non-concessional limits, offering a boost to individuals across the income spectrum.

From July 1st, the ceiling for concessional contributions, including salary sacrifice and the compulsory Super Guarantee, will rise by $2,500 annually to reach $30,000. Meanwhile, non-concessional contributions are set to increase by $10,000 per annum, elevating the limit to $120,000.

While these new limits provide significant room for contributions, it's worth noting that certain rules allow for exceeding them in a single year. For instance, Bring Forward rules permit contributions of up to $360,000. However, adherence to specific conditions is crucial, and careful review of contribution rules based on age is essential to ensure compliance.

Superannuation offers tax advantages, making it an attractive investment avenue for many Australians. However, it's imperative to assess the broader implications of increased contributions, particularly concerning potential impacts on Age Pension entitlements. Balancing tax benefits with long-term financial goals is key to making informed decisions.

As the new financial year approaches, the impending increase in super contribution limits presents an opportunity for individuals to bolster their retirement savings. By understanding the nuances of these changes and considering their broader implications, Australians can navigate this transition with confidence, ensuring a more secure financial future. Remember, seeking professional advice tailored to your specific circumstances can further enhance your financial strategy in light of these developments.

-

The transfer balance cap and how it interacts with the contributions cap

The release of the November Average Weekly Ordinary Time Earnings (AWOTE) figures provides clarity on the thresholds and caps for the fiscal year 2024/25. Interestingly, while contribution caps are set to increase, the general transfer balance remains stagnant, leading to some intriguing dynamics that haven't been encountered previously.

The current system for concessional and non-concessional caps was established in 2017, marking the first time non-concessional contribution caps were tied to a member's total super balance. Since then, due to their linkage to wages rather than inflation, contribution caps have seen sluggish growth, experiencing only one increase on July 1, 2021.

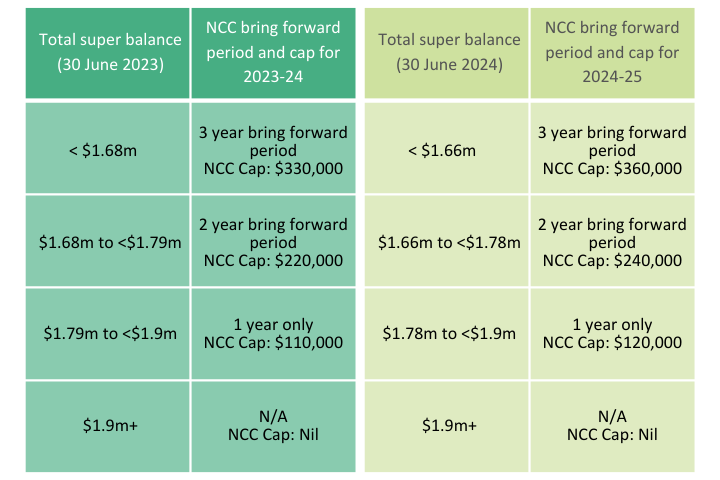

From July 1, 2024, the concessional contributions cap will rise from $27,500 to $30,000. Correspondingly, the non-concessional contributions cap, which is four times this limit, will increase from $110,000 to $120,000 (or $240,000 to $360,000 for individuals utilising the bring forward rules).

However, the static nature of the general transfer balance cap, tied to inflation, introduces notable changes. Specifically, the thresholds for the bring-forward rules are set to decrease next year, making it slightly more challenging for individuals hovering around these thresholds to remain eligible. For instance, someone aiming to commence a three-year bring forward period this year needed to have a total super balance of less than $1.68 million at June 30, 2023. In contrast, the equivalent threshold reduces to $1.66 million at June 30, 2024.

This shift occurs due to the calculation method used, based on the general transfer balance cap ($1.9 million) minus one or two years' worth of non-concessional contributions. For example, a total of $1.66 million at June 30, 2024, translates to $1.9 million less two years' caps ($240,000). Conversely, the calculation at June 30, 2023, resulted in $1.68 million ($1.9 million less $220,000).

Contrastingly, on July 1, 2021, when both the general transfer balance cap and contribution caps increased simultaneously, such nuances were absent.

For individuals already within a two or three-year bring forward period, the benefits of the increase won't be realised until the period concludes. Hence, an individual with a total super balance of $1.7 million who contributes $220,000 in 2023/24 and utilizes the two-year bring forward rules remains capped at $220,000, unable to augment it to $230,000 ($110,000 for 2023/24 + $120,000 for 2024/25).

-

Preservation age hits 60 on 1 July

Since its initial announcement in 1997, the gradual increase of the preservation age from 55 to 60 has been implemented, culminating in a universal requirement as of July 1st. Now, individuals must reach the age of 60 to access their superannuation, including initiating a Transition to Retirement (TTR) scheme. This adjustment also simplifies the definition of Retirement:

Retirement is now characterised by the cessation of gainful employment, with two clear criteria:

- The individual has reached the age of 60 on or before the termination of the employment arrangement.

- The individual has no intention of engaging in gainful employment, either full-time or part-time, in the future.

The upcoming financial year aims to clarify ambiguous situations by introducing criteria that need to be met, tailored to individual circumstances. This simplifies the process, making it more straightforward to determine eligibility. However, it's worth noting that there are additional special conditions of release, such as financial hardship, incapacity, or medical misfortune. These conditions, detailed on the ATO website, may permit partial release of super savings in certain circumstances.